From stocks, bonds, shares, money market securities, to the right combination of two or more of these, however, every option presents its own set of challenges and benefits. So why should investor consider mutual funds over others to get more returns?

Mutual funds allow investors to pool in their money for a diversified selection of shares, managed by a professional fund manager. It offers an array of innovative products like fund of funds, exchange-traded funds, Fixed Maturity Plans, Sectoral Funds and many more.

Whether the objective is financial gains or convenience,mutual funds offer many benefits to its investors.

- Beat Inflation

Mutual Funds help investors generate better inflation-adjusted returns, without spending a lot of time and energy on it.While most people consider letting their savings ‘grow’ in a bank, they don’t consider that inflation may be nibbling away its value.

- Expert Managers

With the help of a professional fund manager the customers are provided with security for their fund invested.The managers are well experienced and so they make right investments yielding more returns for the investors.

- Convenience

Mutual funds are an ideal investment option when you are looking at convenience and time saving opportunity.Money can be easily poured in and poured out from mutual funds.Thus there is convenience of investment in mutual funds.

- Low Cost

Probably the biggest advantage for any investor is the low cost of investment that mutual funds offer, as compared to investing directly in capital markets. Most stock options require significant capital, which may not be possible for young investors who are just starting out.Mutual funds, on the other hand, are relatively less expensive. The benefit of scale in brokerage and fees translates to lower costs for investors. One can start with as low as Rs. 1000 and get the advantage of long term equity investment.

- Diversification

Going by the adage, ‘Do not put all your eggs in one basket’, mutual funds help mitigate risks to a large extent by distributing your investment across a diverse range of assets. Mutual funds offer a great investment opportunity to investors who have a limited investment capital.

- Liquidity

Investors have the advantage of getting their money back promptly, in case of open-ended schemes based on the Net Asset Value (NAV) at that time. In case your investment is close-ended, it can be traded in the stock exchange, as offered by some schemes.

- Higher Return Potential

Based on medium or long-term investment, mutual funds have the potential to generate a higher return, as you can invest on a diverse range of sectors and industries.

Fund managers provide regular information about the current value of the investment, along with their strategy and outlook, to give a clear picture of how your investments are doing. Moreover, since every mutual fund is regulated by SEBI, you can be assured that your investments are managed in a disciplined and regulated manner and are in safe hands. Every form of investment involves risk. However, skilful management, selection of fundamentally sound securities and diversification can help reduce the risk, while increasing the chances of higher returns over time.

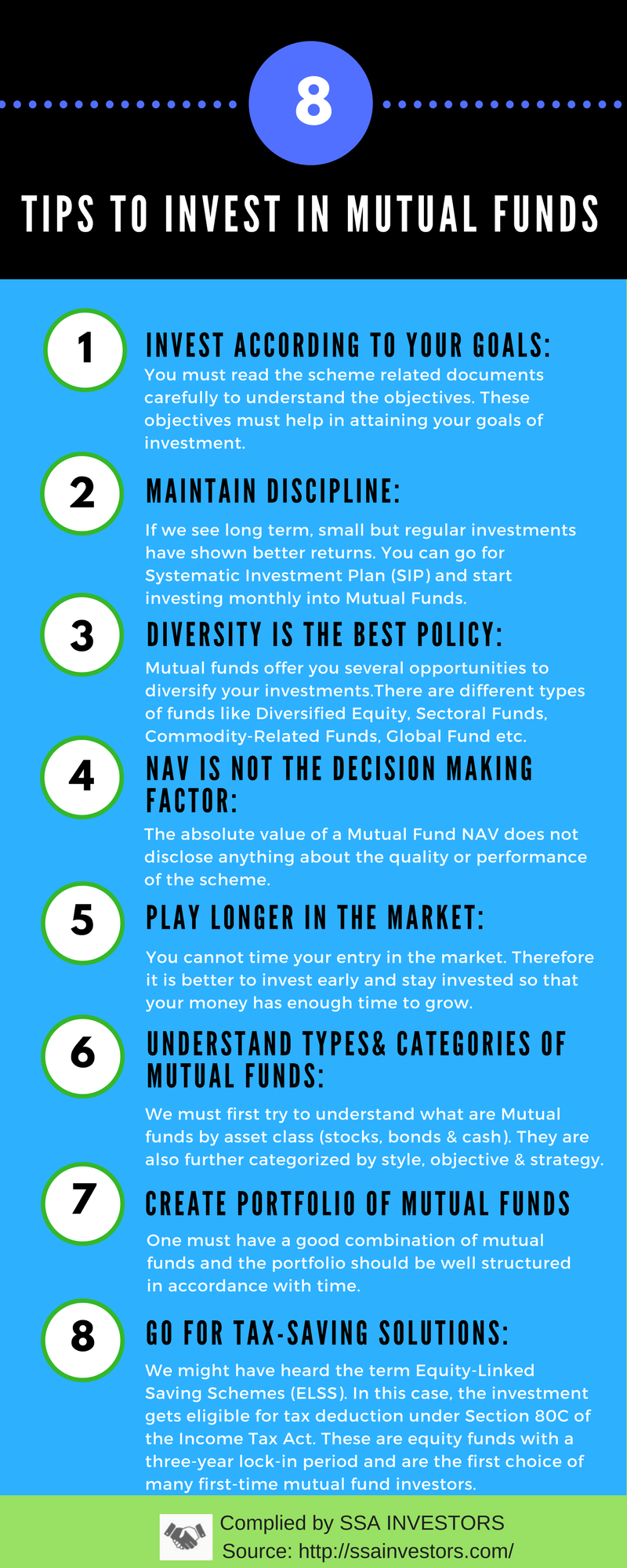

Check out the Tips to Invest in Mutual Funds with the help of this Infographic:

You may also like:

What are mutual funds?

How Federal’s Decision On US Interest Rate Will Effect Indian Market